- Sales Opportunity Management

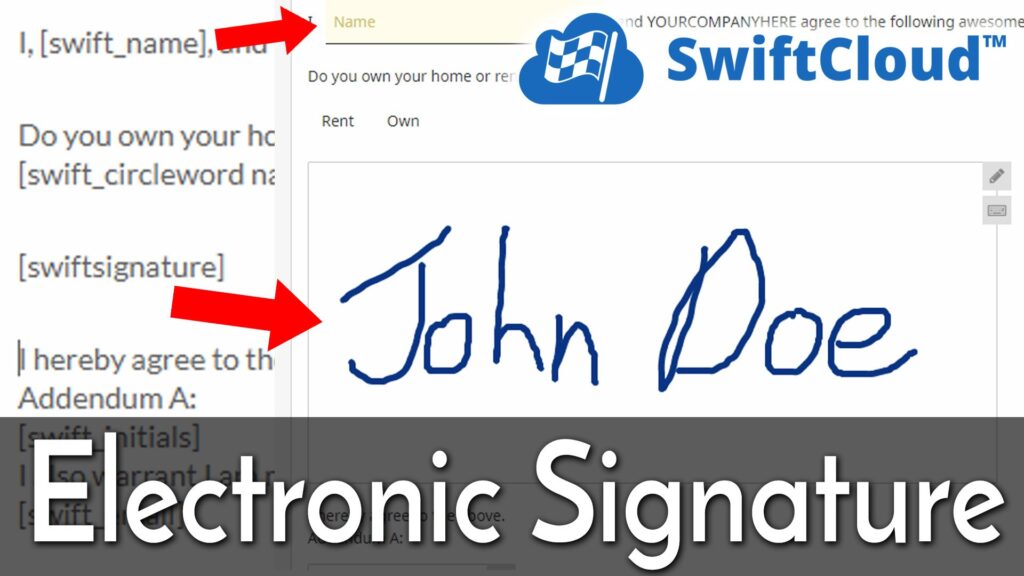

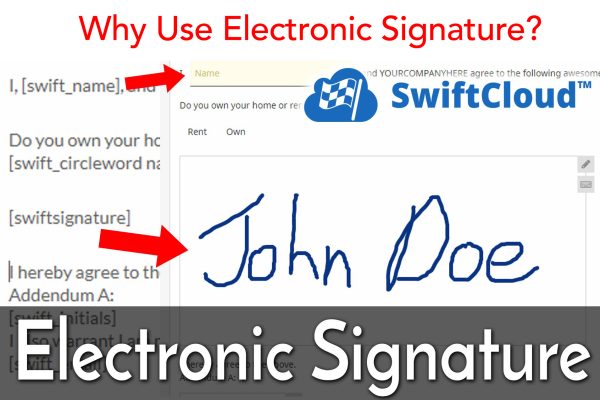

- Proposals, Invoice, Receipts

- AI + Automated Workflows

- Job, Project, Task Management

- Calendar, Scheduling, Timeclock

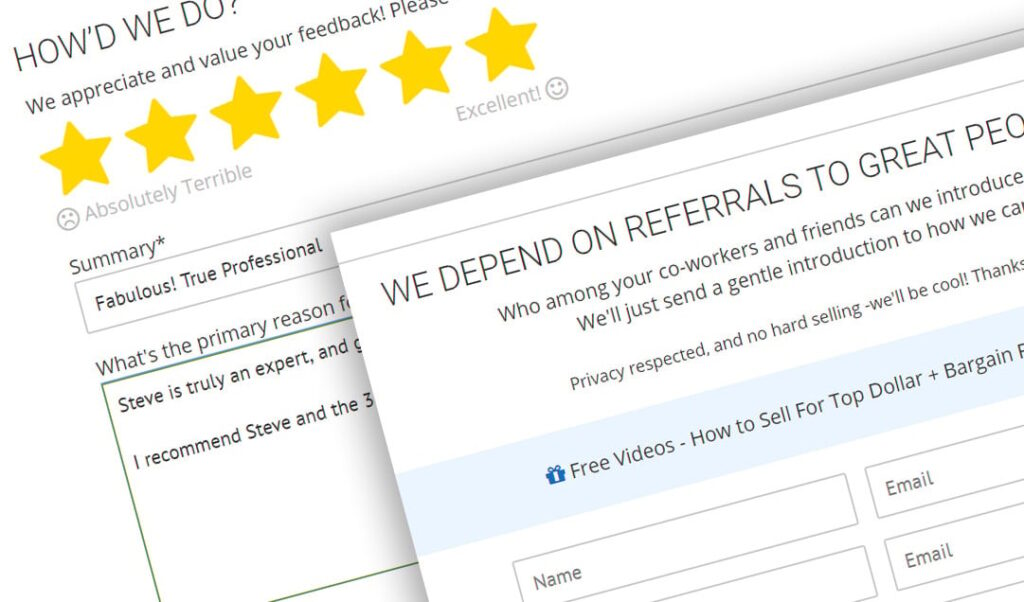

- Communication + History Tracking

Swift CRM Software Overview

Are you managing your business and sales with a mix of email inbox and post-it notes?

If you’re chasing 5 deals, no problem. You’ll remember what you need. If you’re chasing 500, you need us. We’ll help you automate, streamline, get back more time, close more sales, work more efficiently, see who’s doing what, get your team on the same page, and get more sales with less time & effort.